The FinTech space is full of exciting companies with interesting new products right now, from a wife range of new payment processors and innovative fraud prevention companies to new blockchain technology providers.

Many of these companies are seriously disruptive, with technologies and offerings that could potentially change the entire way we transfer money, make payments and manage our financial lives.

As such, the FinTech industry is a great one to keep track of, whether for outreach and prospecting or just to get a feel of the rapid progress being made in digital finance.

Here are 50 FinTech startups that I’m currently tracking and excited about, and those that I think should be on your radar too:

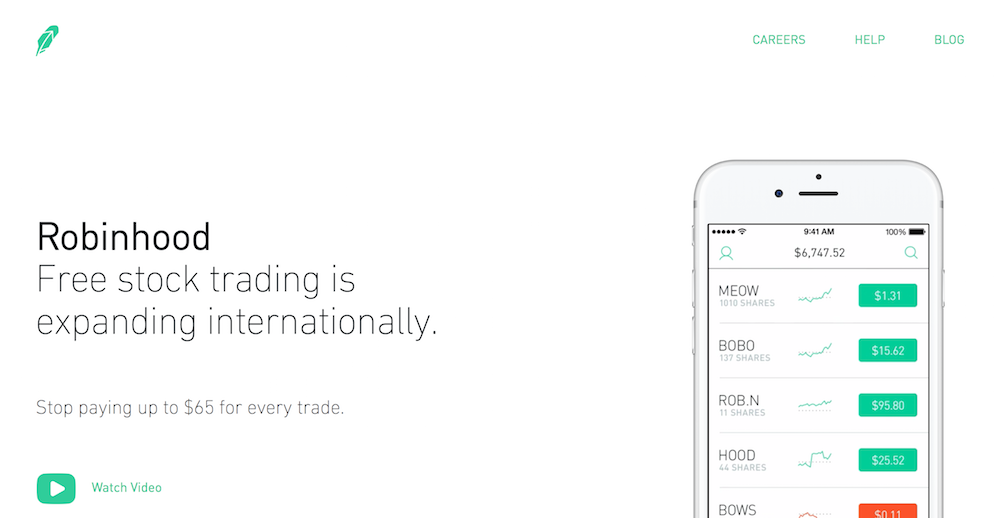

Robinhood

Robinhood is a stock brokerage app that lets you invest your money without the usual fees and commissions. With $0 fees for every trade, Robinhood offers one of the most affordable ways to get started with stock investments.

Unlike most stock trading platforms, Robinhood is designed for simplicity. You can buy and sell stocks at the market rate or place stop loss orders and limit orders. Right now, there’s no short selling or other advanced options, making Robinhood better for beginners than expert investors.

How does Robinhood offer all this without any fees? Well, the free app is subsidized by a $10 per month premium version called Robinhood Gold, which provides extra buying power and access to after-hours trading.

And how are they doing? The team at Robinhood provided me with the following stats:

2M users. $75 billion transacted so far. 50% of investors are first-time investors. Average user is 29 years old. $1.3 billion valuation, with $176 million raised from NEA, Index Ventures, DST Global, and Tchrive Capital.

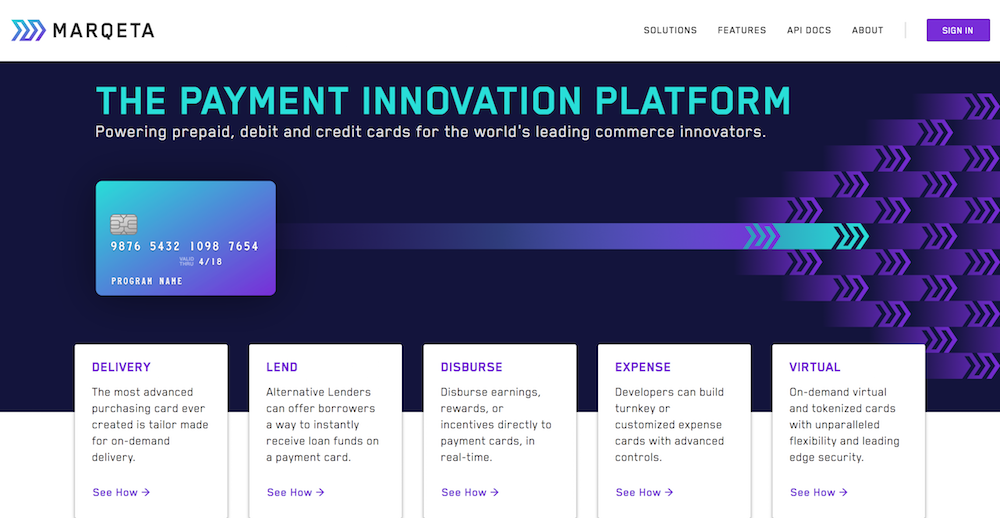

Marqeta

Marqeta is a debit, credit and prepaid card platform that lets you create and manage company funded credit cards. In a few clicks, you can configure, load and manage all of your cards to let your your staff, clients or customers spend with or without limitations.

Designed specifically for developers, Marqeta connects directly to payment card networks such as Visa, Discover and MasterCard, letting you enjoy fast, effective and affordable service with no intermediaries to slow things down.

The Marqeta platform supports both virtual and physical cards, with physical cards designed and produced to your exact specifications.

CEO Jason Gardner tells me:

Marqeta’s unique payment feature, Just-in-Time “JIT” Funding allows companies of all sizes to authorize their own card transactions using a patent-pending process that modernizes how companies engage with transaction processing via Open APIs. With JIT Funding, you can optionally add spend controls via the Marqeta API that limit purchases to specific vendors or types of vendors and/or that cap the frequency and maximum dollar amount of purchases.

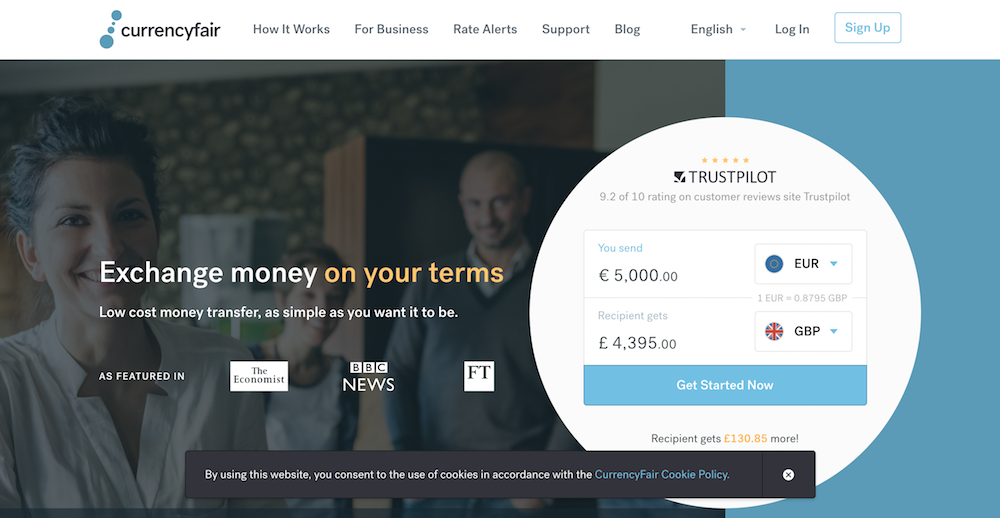

CurrencyFair

CurrencyFair offers fast, convenient and affordable money transfer services, letting you send money in a wide range of currencies without the usual interbank commissions and additional fees.

The biggest advantage of CurrencyFair is its fee structure. Sending money into your account is completely free, with international transfer fees of just £2.50 and exchange rate margins of just £6.00 per £2,000 transferred.

Beyond the low cost, CurrencyFair also offers a speed advantage, with most money transfers completed in one to five business days — a faster pace than the majority of banks.

CEO Paul Byrne shares:

CurrencyFair was originally founded in 2010 as the world’s first peer-to-peer currency exchange platform. Our goal has always been to reduce the cost of international money transfers, by avoiding the excessive fees charged by banks. We’ve now grown into a community of over 100,000 users, who to date have saved over €180m by accessing FX rates substantially better than those offered by banks and brokers.

Final

Final is an online credit card service that lets you provide a unique credit card number to every merchant, protecting your real financial information from data breaches and helping you avoid the long, frustrating process of canceling your credit cards after a data breach.

It also makes it easier to cancel unwanted subscription payments. Instead of having to call the merchant or cancel your card, all you need to do is deactivate the Final card number you used for that specific transaction.

Final even allows you to set limits for each merchant, helping you avoid being overbilled for a product or service you’ve purchased on recurring billing. If you do a lot of online shopping and want to stay in control of your spending, Final is definitely worth adding to your financial toolkit.

CEO and Co-Founder Aaron Frank tells me:

Final has built its own modern credit card technology stack – something unique in the industry – and in addition to our consumer card offering we have dozens of banks and co-brands who are looking to issue cards on our platform.

Trulioo

Trulioo is an online identity verification service that lets you instantly verify four billion people in more than 60 countries. Designed to prevent fraud, Trulioo uses data such as identify, age and address to verify individuals and match customers to existing profiles.

As you’d expect for such a massive app, Trulioo uses a variety of databases to provide reliable, high quality identity data. Records include utility bills, credit bureau information, government IDs such as passports and driver’s licences, and even social and mobile CyberID data.

If fraud is an issue in your industry, Trulioo’s huge amount of data and useful identity verification tools make it a great app to add to your collection.

We’ve been experiencing rapid growth the past few months. Since January the number of Trulioo employees has doubled, and we plan to double our team once again by next year, bringing us to a total of 100 team members.

Finimize

Finimize is a financial news service and financial guidance platform designed specifically for a millennial audience. Designed for simplicity, it takes less than three minutes to get started with Finimize MyLife and start becoming your own financial adviser.

There’s also a Finimize newsletter, which lets you stay on top of the most recent financial news and developments in just a few minutes a day. Both tools are free, making it easy for people with an interest in improving their finances to start proactively learning and taking action.

Co-founder Max Rofagha tells me:

At Finimize, we’re on a mission to empower our generation to become their own financial advisers. We started by creating a community of people who are interested in better understanding the world of finance via our free daily financial newsletter. Without any marketing spend, we’ve grown this community to more than 130,000 people. Now, we’re introducing a new product to our community: Finimize MyLife – it allows you to create a financial plan within a few minutes and we’ll help you execute it. We already have more than 25,000 people who have registered to get access to it.

Affirm

Affirm is an online consumer finance service that lets you pay over time for your purchases with a simpler, faster application process than most financing options.

Buying things with Affirm is simple. If a store accepts Affirm, customers can check out using an affordable payment plan that fits their budget. Payments are tracked every month until the loan is fully repaid, making it easy for customers to stay on top of recurring payments.

For businesses, Affirm offers a simple way to make your product or service more affordable for customers and increase your conversion rates. Used by companies like Jomashop and Reverb, Affirm is available for e-commerce platforms ranging from Magento to Shopify and more.

TAB

TAB is a marketplace finance analytics and intelligence service that provides new insight into financial data for asset managers, banks, academics, consultancies, hedge funds, agencies, investors and service providers.

Designed for a variety of audiences, customers can use TAB to find sales leads and discover opportunities, explore new asset classes, research investment opportunities using the latest, more accurate data and even use crowd finance data to run more successful fundraisers.

TAB covers a variety of marketplaces, including crowdfunding and marketplace finance, giving it immense potential value for everyone from investors to banks, funds and agencies.

CEO Emily Mackay shares:

TAB now covers around 1000 platforms globally, processing billions of data points on around 6 million instances of online capital raising.

Artivest

Artivest is a technology platform that digitizes private equity and hedge fund investing for the high net worth channel. Artivest applies the user-focused operations and technology of popular e-commerce platforms to the experience of investing in private alternatives.

With a single log-in powering diligence, subscription and ongoing reporting, Artivest provides a complete solution for advisors to scalably grow their alternatives business.

CEO and founder James Waldinger shares:

Individual investors are demanding that their advisors offer compelling investment opportunities and that they use technology to help them manage their wealth more effectively and more transparently. Advisors and advisory firms appreciate how Artivest has removed the “pain” from all parts of the investment lifecycle — qualifying the client, sharing marketing materials, affecting subscriptions and integrating reporting results.

Raisin

Raisin is a deposit marketplace that lets you decide where to invest your money in Europe. The platform offers 100% deposit protection for up to 100,000 EUR per customer and bank, allowing you to invest with confidence.

After you’ve transferred funds into your Raisin account, you can place your funds into a range of partner banks through term deposits. With competitive interest rates, Raisin offers a higher rate of return on your investment than many other deposit options.

CEO and co-founder Tamaz Georgadze shares:

What makes Raisin special is that we have managed to integrate with almost 40 banks across Europe. Our customers also feel this way and currently invest a billion euros into savings products every quarter via the Raisin platforms.

Track

Track is a tax management platform for freelancers and other self-employed people that lets you save time and automate large aspects of your tax planning.

When you receive money from a client or customer, Track lets you automatically set aside some of the payment for taxes. The money that you owe is tracked automatically and payments to the IRS are filed effortlessly in the background.

Aimed at US-based freelancers, Track can even connect you with a network of CPAs for more complicated tax questions and professional advice.

CEO and co-founder Trent Bigelow shares:

Track is the only app that automatically withholds enough for self-employment taxes. Track has analyzed more than $50 million in transactions and resulted in tens or thousands of hours saved for our members.

Paybase

Paybase is an end-to-end payment solution that lets you manage everything from payments to risk in one interface.

Designed for startups, small businesses and crowdfunding websites, Paybase offers a complete payment infrastructure. Licensed as an EMI by the FCA, it manages everything from offering a variety of payment providers to taking care of compliance and risk management.

Add comprehensive security and 99.95% uptime into the equation and Paybase stands out as a great end-to-end payment option for startups that need to accept payments, monitor fraud and stay compliant with financial regulations.

CEO Anna Tsyupko shares:

With Paybase, payments infrastructure finally becomes a real engine for innovation – helping you build better products.

AngelList

AngelList is a recruiting and investment platform designed to connect job seekers, founders and investors. Used by companies like Facebook and Uber, AngelList is a great place to search for new opportunities at rapidly growing technology companies.

From an investment perspective, AngelList makes it easier to identify early-stage startups and build a portfolio of investments. Investment opportunities on AngelList range from deal-by-deal investments to startup funds that provide exposure to 150+ different investments.

If you’re looking to get involved in the startup community, whether as an investor or employee, AngelList is a must-have resource for discovering and capitalizing on new opportunities.

Coinbase

Coinbase is a digital currency exchange that lets you buy and sell everything from bitcoin and litecoin to ethereum. Coinbase’s mobile wallet works on a variety of devices, letting you carry your digital assets with you anywhere you go.

Whether you’re interested in investing in digital currencies or purchasing bitcoin for shopping, Coinbase includes all of the digital currency features most people will need in a simple, sleek interface that makes the process of using digital currency less intimidating.

Is Coinbase the most powerful digital currency platform on the market? No, but it does offer a level of user friendliness and simplicity that makes getting started with digital currency a breeze, even for complete beginners.

Square

Square is a credit card processing platform that lets your small or mid-sized business accept credit cards anywhere. Designed for retail and simple point of sale, Square includes all of the payment processing tools the average small business could ever need.

Using Square, businesses can accept all major credit cards and receive bank deposits in as little as two days after each transaction. Square includes a full point of sale system, making it easy to set up your products and services and manage your inventory in real time.

You can even take out a loan from Square Capital, letting you fund your business using existing cash flow to prove you’re credit worthy.

Stripe

Stripe is an online payment processor that makes accepting credit cards faster, less stressful and less expensive. Designed for small and mid-sized businesses, Stripe lets you quickly add the option to pay by credit card to your website, helping you increase your conversion rate.

With a built-in checkout, Stripe lets you add credit card processing to your e-commerce website or service business in just a few clicks. You can even customize the payment flow to match your site’s design and create a better purchasing experience for users.

At 2.9% plus a small transaction fee, the cost of using Stripe is very reasonable, and for most businesses, significantly cheaper than setting up and maintaining a private merchant account.

SoFi

SoFi is a modern finance company that offers affordable rates for mortgages, personal loans and student loan refinancing. An online-only lender, SoFi aims to use its lower operating costs as a way to provide more affordable financing to customers.

Applying for a mortgage or personal loan through SoFi is quick and simple. All applications are processed online, with applications reviewed using criteria ranging from a traditional credit score and debt-to-income ratio to factors like education and estimated cash flow.

SoFi also offers investment management, letting you invest your savings into diversified index funds with no fees for your first $10,000 invested.

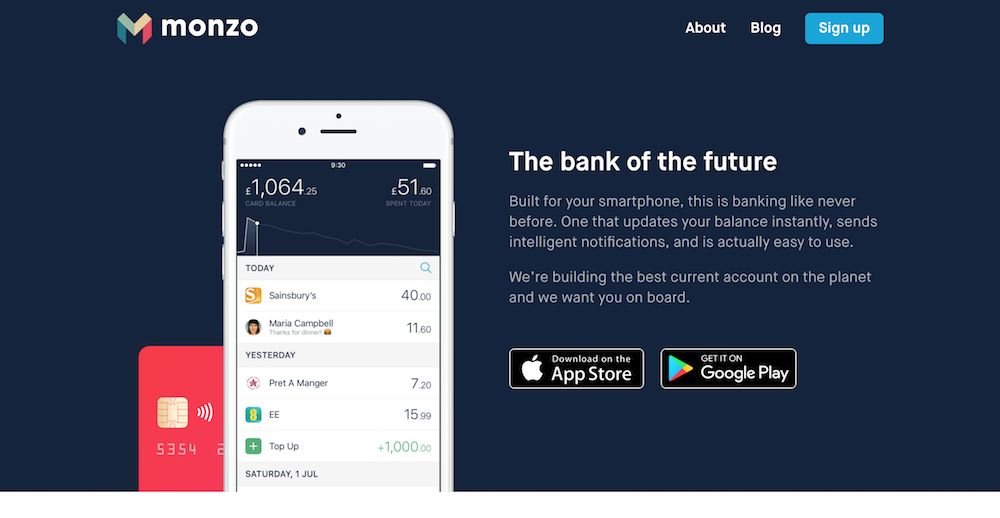

Monzo

Monzo (or Monzo Bank Ltd), is an online-only bank that bills itself as the “bank of the future.” It’s built specifically for your smartphone and offers everything from no-fee international transactions to smart receipts for the purchases you make using your card.

Useful features of Monzo include spending tracking, which lets you keep track of your monthly spending and track it against a predetermined spending goal. Monzo also calculates data like your average spend at specific businesses, from cafés and retailers to gas stations.

Finally, there’s even a contact book, letting you quickly and easily save friends, family members and colleagues to quickly and easily send cash in a few clicks.

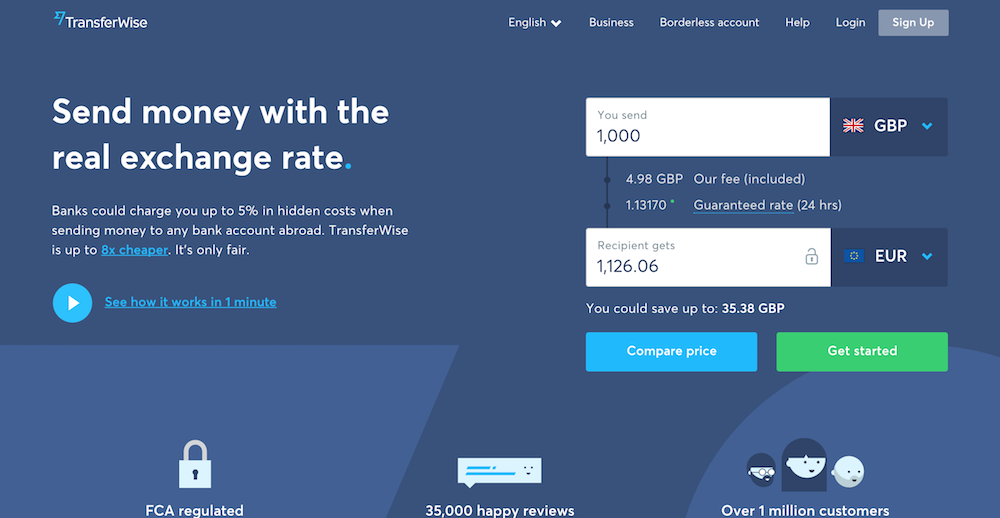

TransferWise

TransferWise is an online money transfer and currency exchange service that lets you send and receive money from friends, family members, colleagues and customers without being subject to the usual exchange and transaction fees.

Billed as a way to get the “real exchange rate,” TransferWise offers cheaper currency fees than banks and online money transfer services like PayPal. It also offers borderless accounts that let you send, receive and store money in a variety of currencies.

If you’re a frequent traveler or entrepreneur who buys and sells products and services in foreign currencies often, TransferWise can help you shave a huge amount off your total transaction fee spending.

Blockstream

Blockstream is a blockchain technology provider that produces sidechains and other bitcoin applications. After releasing its Liquid sidechain in 2015, Blockstream announced that it will soon offer Blockstream Satellite in the future.

As well as its technology, Blockchain is one of the largest contributors to Bitcoin Core — a full featured bitcoin client that was first released in 2009.

Wealthfront

Wealthfront is an investment management startup that offers free management services for the first $10,000 you invest. After connecting your accounts, Wealthfront analyzes your data to find insights and potential investment opportunities.

Based on your financial data, Wealthfront can suggest tailor-made strategies to help you reach your financial goals. Through the software, you can execute a variety of investments to put your money to work and produce measurable, real progress.

As for the cost, Wealthfront only charges a 0.25% annual advisory fee, without any commissions or hidden fees.

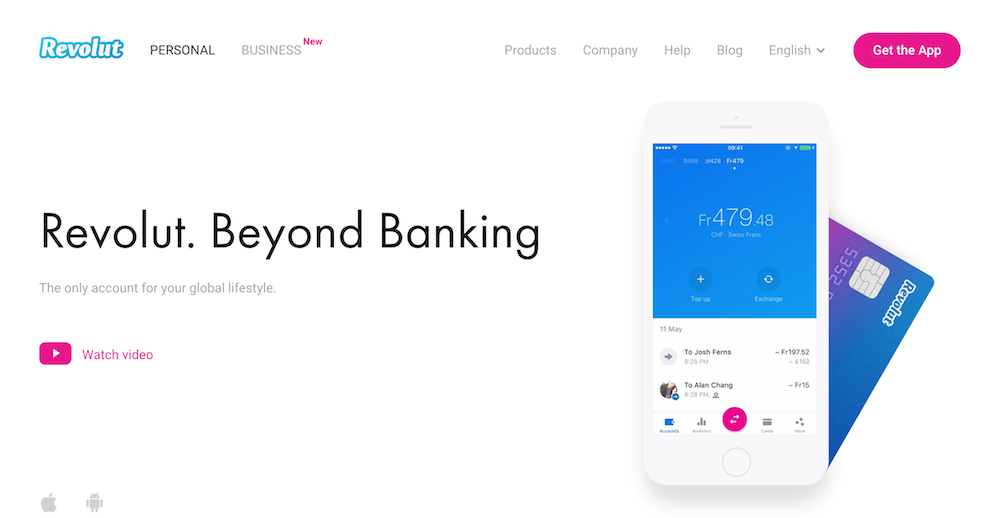

Revolut

Revolut is an online banking service that removes all currency exchange fees from transactions, letting you send, receive and spend money without the usual commissions, fees and other costs involved in international commerce.

Built around the RevolutCard, this makes Revolut perfect for frequent travellers that need to pay for products and services and withdraw money in foreign currencies. Revolut also lets you send money in more than 26 currencies, all with minimal fees.

You can also deliver money requests to your contacts for things like rent and purchases, making it easy to keep track of small debts and payments.

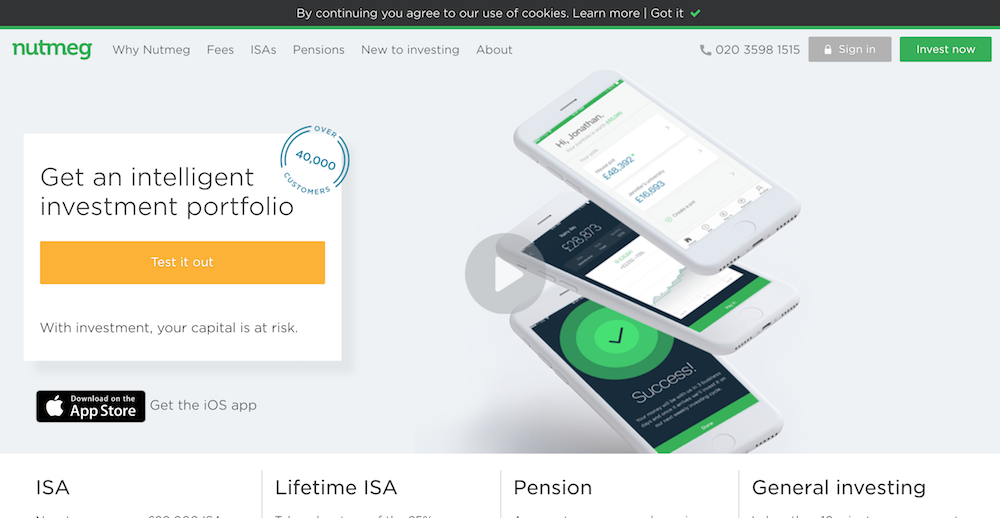

Nutmeg

Nutmeg is an online investment management service that allows you to build a diverse online intelligent portfolio. Investments through Nutmeg are fully managed, meaning you have a team of experts at your side for tasks like diversifying and managing your capital.

Like other online investment management platforms, Nutmeg charges a fee for its services. For the first £100,000 you invest, you’ll pay a 0.75% commission. For anything beyond £100,000, it only costs 0.35% of your total investment.

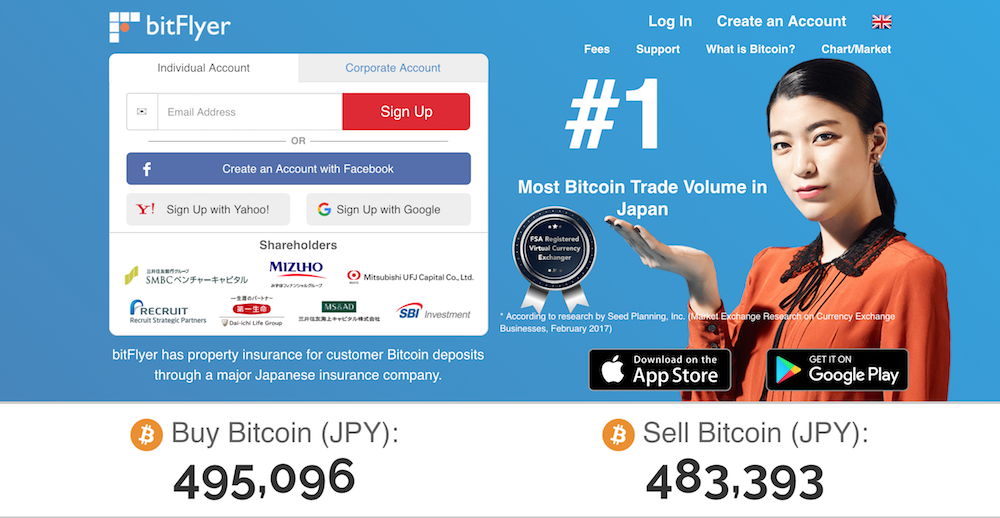

Bitflyer

Bitflyer is a Japanese bitcoin exchange and marketplace that lets you quickly and easily start purchasing and storing bitcoin. Fast and simple, bitcoins purchased or sent using Bitflyer are transferred in one second, helping you avoid long and frustrating transfer delays.

As well as its Japan-based offices, Bitflyer recently opened an office in San Francisco, with a focus on providing bitcoin exchange and trading services to customers based in the USA and other Western, English-speaking markets.

As for fees, Bitflyer is fairly affordable — there’s a 0.01-0.15% trading fee for bitcoin and a 0.2% trading fee for altcoins.

Ripple

Ripple is an online funds transfer and currency exchange network that allows for fast, simple and convenient transfers between different payment networks, payment providers and digital asset exchanges.

Key features of Ripple include real-time traceability of funds and instant, on-demand settlement of transfers. Completely decentralized, the Ripple network can even operate without the Ripple itself being online.

Ripple is already used by companies like UBS and Santander seeking to offer faster, easier and less expensive transactions between account holders.

Alipay

Alipay is one of China’s largest online payment platforms, offering everything from simple money transfers to fast and convenient mobile payments for products, services, utilities and even public transportation in many Chinese cities.

Outside of China, Alipay doesn’t quite have the same level of popularity, but still acts as a useful money transfer service for businesses that work with Chinese suppliers, service providers and other companies.

Alipay also has services for other Asian markets, making it worth adding to your financial toolkit if you do business in East or Southeast Asia.

Chime

Chime is an online bank account that helps you save money automatically. WIth no minimum balance, no monthly fees and no foreign transaction fees, Chime lets you enjoy all of the key features of a bank account without many of the annoying costs.

Chime accounts, which come with a Chime Visa Debit Card, include an automatic saving tool that rounds up transactions to the nearest dollar and transfers the remaining balance into your savings account, helping you slowly but gradually build a positive balance.

You can also choose to automatically deduct a certain amount of your paycheck into savings, quickly and easily pay friends and family online, get paid up to two days early and monitor your spending with instant notifications.

Blockstack

Blockstack is a decentralized network that offers a blockchain-powered, tokenized internet for developers and end users. Built around a decentralized browser, Blockstack runs apps on its own range of blockchains, aiming to become a “Netscape for the decentralized internet.”

Currently, Blockstack is available as a browser add-on that works with Chrome, Firefox and Safari. Payments in Blockstack are handled using Bitcoin and other cryptocurrencies, offering an additional level of privacy and control for users.

Tala

Tala offers a new way to evaluate people’s creditworthiness, using a wide range of data points to provide smarter, more helpful credit to people and businesses interested in borrowing money for a variety of purposes.

Aimed at people without the usual credit history, Tala can be used for everything from short-term personal borrowing to loans for businesses. As customers borrow, they can build their financial identity, improving their access to other credit sources in the future.

Digit

Digit is a savings application that automatically calculates the perfect amount of money to save every day, making it easy for you to automatically add cash to your savings account based on your spending habits and income.

Over time, the small amount added to your Digit account can build up into a substantial balance, letting you effortlessly save without any extra work. Accessing your money is simple — all that’s required is a quick SMS to Digit, which will trigger a release of some or all of your savings.

Digit even offers 1% annual cash back on your savings, plus FDIC insurance and safe, effective 128-bit bank-level encryption.

Klarna

Klarna is a payment service provider that offers a variety of payment options designed to reduce risks and improve service for both merchants and customers.

Popular in Sweden, where it powers as much as 40% of all e-commerce transactions, Klarna is designed to let customers pay directly at the checkout, pay after receiving and trying a purchase or slice up payments into multiple installments.

Available as an extension for several e-commerce platforms including WooCommerce, Klarna can be a powerful tool for improving your e-commerce conversion rates while giving customers a greater variety of ways to pay for your products and services.

Orchard

Orchard is a lending platform that connects loan originators and institutional investors to provide smarter, more effective options for lending businesses while allowing investors to deploy capital more efficiently.

From an investor perspective, Orchard makes it easier to discover new opportunities and make smart, effective investment decisions. For originators, Orchard provides the platform required to scale up and improve their lending business with better data and more detailed reporting.

Adyen

Adyen is a payment processing platform that lets you accept Visa, MasterCard, Amex, PayPal and other payment options with ease. Designed for everything from e-commerce to retail point of sale, Adyen is built with a wide range of different businesses in mind.

Beyond the usual credit cards and PAyPal, Adyen supports payment channels such as Alipay, Paysafe, WeChat Pay and even direct debit with specific banks and card providers. There is also comprehensive risk management to protect your business from fraud and other issues.

Adyen pricing is largely in line with other platforms, with an Interchange++ pricing model for credit cards and a range of commissions for alternative payment methods.

Curve

Curve is an online credit card and account aggregator that lets you upload all of your credit and debit cards, then use one single card to pay for all of your purchases.

Billed as a form of “financial time travel,” you can use Curve to choose which card to make your purchases from after you make each purchase. Curve also records all of your spending history, with detailed receipts showing how much you’ve spent and where you’ve spent it.

Add super low foreign exchange rates and simple data export into the mix and Curve stands out as an excellent option for small businesses and individuals that want to gain more control over their credit or debit card spending.

Tink

Tink is a personal finance app that lets you keep track of your savings and spending, all from a simple user interface. Designed to connect to your bank accounts and cards, Tink automatically tracks your saving and spending, giving you a full summary of your financial status.

You can also use Tink to pay bills, approve e-bills and transfer money between your accounts or to friends and family. Tink even lets you compare mortgage deals and open a savings account, letting you maximize the interest you earn from your account balance.

Developed in Sweden, Tink’s biggest audience is domestic, although it is expanding rapidly into other European markets.

CEO Daniel Kjellén shares:

Tink is the smartest way to make better financial decisions. Launched in 2013 and with over 400 000 users in Sweden, our aim is to create financial happiness for our users. Our app lets you connect all your banks and cards, track and manage your money, get personalized advice and cherry-pick the best financial products. All in one place. This means that we are opening up the market and make sure that the best banking products ends up with the right customers.

Ant Financial

Ant Financial is an affiliate company of Alibaba Group — one of China’s largest e-commerce and online services businesses. Designed to provide inclusive finance, Ant Financial offers financing to individuals and small businesses throughout Asia.

It also offers green financing aimed at businesses that use green, low-carbon business practices and sustainable manufacturing. Ant Financial’s green financing also provides preferential credit for people that purchase fuel-efficient vehicles and other green technology.

Aire

Aire is a “true credit score” provider that gives people a more accurate, detailed credit score to help them access loans and other forms of financing.

Designed to provide a fresh, new approach to credit reporting, Aire allows you to build your own credit profile by submitting data that proves you’re worthy of credit. Aire then uses an algorithmic scoring engine to calculate your score based on a variety of criteria.

As a result, there’s no data bias or scraping of social media data — instead, your credit score is calculated using a variety of data points that provide a more accurate, comprehensive view of your ability to access and responsibly use credit.

AvidXchange

AvidXchange is an automated bill payment and accounts payable platform that lets you process payments faster, manage your accounts payable more efficiently and stay on top of the people and businesses that owe you money without the usual paperwork.

Designed to eliminate filing cabinets, AvidXchange integrates with over 100 different accounting systems, letting you quickly and easily add it to your company’s financial toolkit to start tracking invoices and receiving payments more efficiently.

The end result is a faster close time and a more efficient business, letting your team spend less time following up on bills and invoices and more time running and growing your company.

Zelle

Zelle is a money transfer app that lets you send money to anyone using your smartphone or mobile device. Designed for simplicity and convenience, sending money via Zelle is as simple as choosing a person to pay and specifying the amount of money to transfer.

Enrolling in Zelle is a simple process. You can sign up using your email or mobile number and quickly add your account in just a few steps. When you transfer money, your recipient receives an instant notification, letting them stay on top of bill payments and other transactions.

Right now, Zelle is only available to US bank account holders, with a one to three business day period required for transactions to individuals not already enrolled in Zelle.

Hijro

Hijro is a global financial operating network built on blockchain technology. Founded in 2014 and most recently funded in mid-2016, Hijro is designed to connect banks, buyers and suppliers via one network to provide faster, more secure transfers.

Using Hijro, you can link your ERP or e-invoicing platform to provide financing services for your customers directly. Hijro also features modular APIs, letting developers create applications that use the platform for a range of purposes.

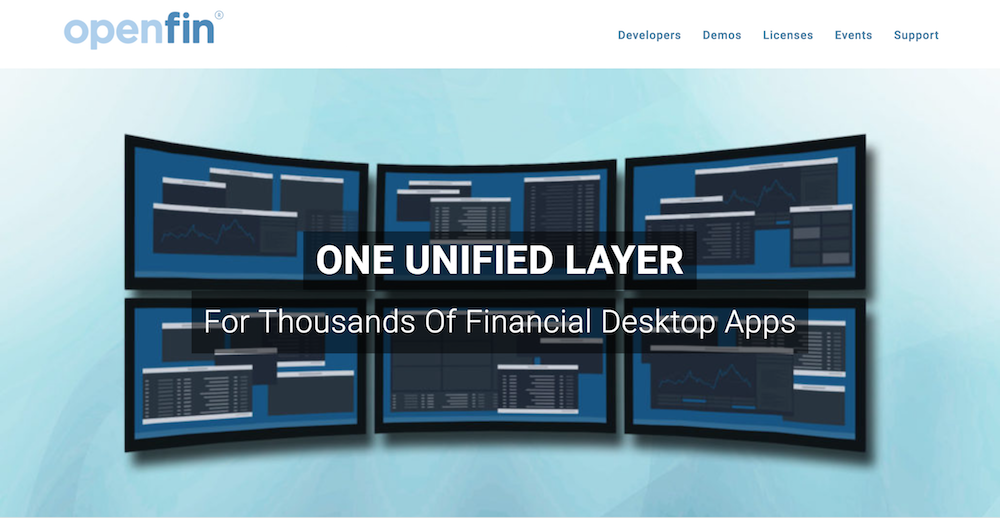

OpenFin

OpenFin is a provider of runtime technology for financial businesses, used by a variety of well known banks and financial trading platforms. Designed to be an “operating system for financial desktop apps,” OpenFin powers a variety of HTML5-based applications.

Advantages of OpenFin include its rapid development time, letting developers quickly build new desktop financial apps. The software is built using Google’s Chromium project and has found an existing audience of banks, trading platforms and other financial software companies.

Signifyd

Signifyd is a fraud prevention startup that allows you to accept more international and domestic orders while reducing your risk of having to deal with fraudulent transactions, chargebacks and other common payment-related issues.

Instead of approving payments manually, you can skip the research and automate your entire back office process, letting you process payments without the usual slow, inefficient process of manually approving orders.

Signifyd also includes detailed reports for each transaction, letting you monitor orders with a score and detailed explanation of why they were approved or rejected.

Seed

Seed is a mobile banking provider aimed at small to mid-sized businesses. Each account comes with all of the essentials, ranging from a mobile banking account to a Visa Business Debit Card, mobile check deposits and electronic bill payment.

Aimed at startups and small businesses, Seed allows you to easily link external bank accounts and make transfers in just a few clicks. There’s also detailed reporting, letting you see how and where you spend your money on a monthly basis.

Blend

Blend partners with banks and lenders that make borrowing money for your next home or apartment purchase quick and simple. With a variety of lending partners, Blend can connect you with the right lender for your needs and situation based on your financial data and application.

Borrowing via Blend starts with a short survey. After this, you can digitally connect your finances to prove your creditworthiness and access a variety of loan options to purchase your apartment, home or other type of property.

Varo

Varo is an online banking service that lets you open an online, on-demand bank account without the hassle of a traditional bank. Accounts are managed through The Bancorp Bank and provide all of the features you’d expect without the usual fees or frustrations of personal banking.

As part of your Varo account, you’ll receive a debit card and a mobile record of your statements and account activity. Varo even offers fee-free withdrawals at more than 55,000 Allpoint ATMs to make using your card as affordable and convenient as possible.

Greenlight

Greenlight offers debit cards for children, with a great range of parental controls that you can manage from your mobile decide. Available on iOS and Android, you can control your child’s access to money remotely, letting you set spending limits and view account activity.

Greenlight’s controls are flexible, letting you choose exactly where your children can shop or provide total access at any retailer. Greenlight cards can also be shut off in seconds, making it easy to respond if your child loses their debit card while at school or out with friends.

Add real-time spending notifications and simple allowance payments and Greenlight stands out as a great option for parents that want to give additional financial independence to their kids.

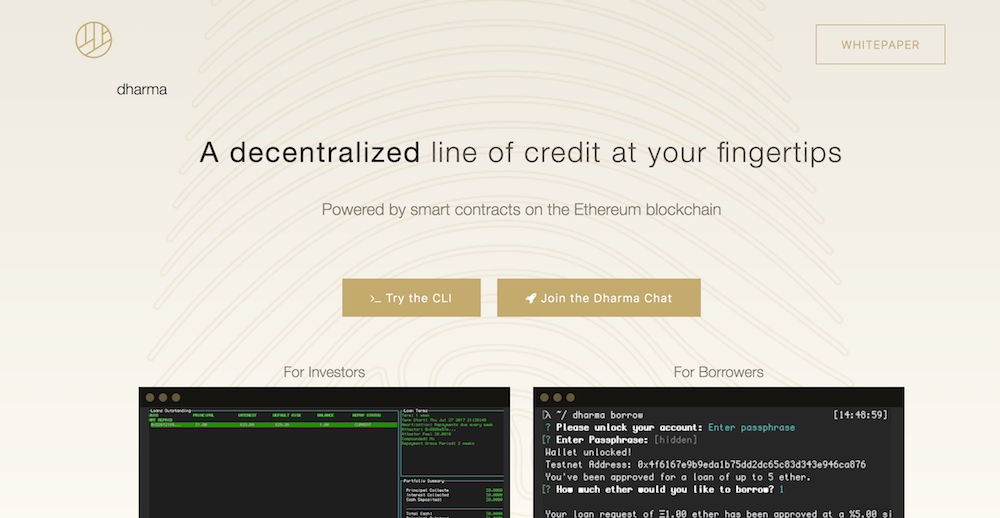

Dharma

Dharma is a software suite designed to help people loan and borrow cryptocurrency. In just a few lines of code, developers can quickly and easily add a line of credit to their app or wallet, letting customers borrow cryptocurrency with ease.

Using ERC-20 tokens, Dharma allows individuals and businesses to invest in loans made via the Dharma network. Loans are administered via a contract on the Ethereum blockchain, with third-party risk assessment to prevent loans being made to non-creditworthy borrowers.

Keza

Keza lets you invest your bitcoins into any stock market, giving investors the chance to access a variety of conservative, moderate and aggressive risk portfolios.

Originally launched in 2015, Keza was acquired by Philippines-based Satoshi Citadel Industries last year. The company hopes to provide new levels of access to investors located outside the developed world, whether “from Lagos, Istanbul or Toronto.”

Currently, Keza is available for iOS devices via the App Store. The company’s website is light on details at the moment, but the technology behind the app certainly has the potential to create a range of opportunities for savvy investors around the world.

Empower

Empower is a savings app that can help you discover potential savings in the form of unused or unwanted subscription payments, big bills that can be negotiated and high interest accounts that you can use to maximize your savings.

Designed to link up with your bank accounts, Empower automatically tracks your earnings and spending to let you know where you’re at financially at any moment. As you spend money, you can keep track of how close you are to your monthly spending limit.

Empower even auto-categorizes your spending, letting you monitor where and how you spend your money to discover new opportunities to save.

Captable

Captable is a free cap table creation and management tool that lets you quickly and easily build eye-catching, clean cap tables for new businesses and investments.

Designed for startups in the planning and founding stages, Captable lets you create cap tables in just a few clicks. Users can show important details such as ownership percentages and total investment, as well as the total value of equity in the company.

It also lets you quickly and easily grant stocks, convertible instruments, stock options, warrants and other items for founders, employees and investors. There are even tools for modeling future investments, viewing liquidation preferences and collaborating with investors and co-founders.